Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

HANDBOOK AND TEMPLATES

Listen to the introduction to Business Models for Financial Advisors read by Christine Timms.

Read the introduction to Business Models for Financial Advisors.

Peek at the table of contents to see all of the topics the book covers.

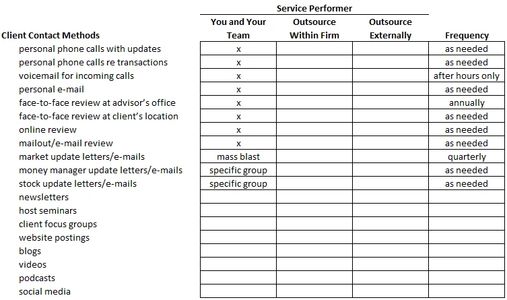

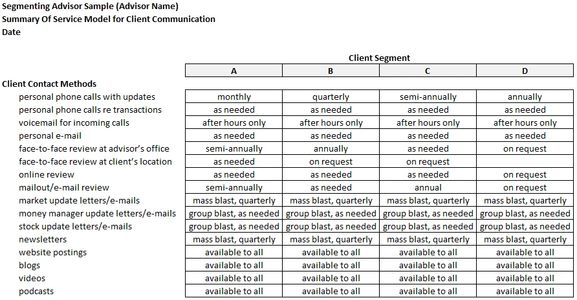

A well articulated, written business model is a valuable tool for advisors at all stages of their career. Advisors having a deeper understanding of their own practice and who it serves best, will lead to sustainable relationships based on a win-win business model. I define an advisor’s business model as the articulation of who the advisor’s most compatible clients are, the services and products that the advisor offers those clients, how those products/services are provided, how clients are charged and how the advisor is paid. I show how advisors in all stages of their careers can benefit from a well-defined business model, even those about to retire. The handbook provides a checklist process to quickly articulate, develop or analyze an existing or desired unique business model. I provide an example of the process by showing completed checklists based on the final years of my practice and the resulting printed business model. I include discussions regarding many of the required decisions as we progress through the checklists for the various business model components. I also discuss household capacity of practices and provide an analytical tool and checklists to facilitate the segmentation of clientele. This handbook includes appendices “Why Advisors are Not Interchangeable”, “Why Many Revenue Sharing Advisors Have and Deserve Above Average Incomes” and “The Average Advisor of Various Financial Advice Channels.”

“The ideas and templates Chris developed in Business Models for Financial Advisors are useful and practical. Advisors like myself can benefit immensely by using these tools to help structure our practice and therefore provide a more consistent and positive client experience.”

—Maili Wong, CFA, CFP®, FEA

Executive Vice-President, Senior Investment Advisor & Senior Portfolio Manager,

Director, Wellington-Altus Holdings Inc.

Author of Smart Risk: Invest Like The Wealthy To Achieve A Work-Optional Life

Named:

2022 Canadian Advisor Of The Year (Wealth Professional)

One of Report On Business 2021 SHOOK Canada's Top Wealth Advisors

One of Canada’s Most Powerful Women: Top 100TM by WXN

“I really like your approach and, in particular, all the useful templates and checklists you provide. It is far more practical than many practice management books I have read over the 32 years I have been in the industry.”

—Gary Mayzes

Senior Vice-President & Regional Manager, Wellington-Altus Private Wealth

Over 30 years experience in the investment advice industry

“Business Models for Financial Advisors has been a valuable source of ideas and tools for my practice. The service model (communications, investing, tax, resource management, pricing/client cost) checklists provided us with documented questions on areas we may have thought of previously but have never written down as a defined process. It created awareness that we may not be going as deep into personalizing meetings for each client. My associate specifically found the financial planning service model helpful. Along with our current model, he appreciates the detail put into the checklists. I think they would be a major asset for advisors that lack process and a huge asset for advisors early in a career.”

—Kevin Punshon

Financial Advisor for over 30 years

Chairman’s Club member

Branch Manager Big Five Canadian Bank owned brokerage firm

“The ideas and checklists presented in Business Models for Financial Advisors are very timely and helpful for us to use as a business planning tool as we develop and settle our business plan forward and develop the appropriate business model(s) to help us accomplish our objective.… It is, in aggregate, a superb tool for us to use to help all of the people in my practice determine, define and settle the forward direction we need to take our business to the next higher level.”

—Rollie Guenette

Financial Advisor for over 25 years

Chairman’s Club member

Big Five Canadian Bank owned brokerage firm

“Your business models book was excellent. I’ve shared it with my team to read so that we can implement some of your best practices. It’s always valuable to take a deeper dive into your business and be continually improving on the efficiency and what you have to offer. Your book pushed us to do that.”

—Adam Slumskie

Portfolio Manager

Financial Advisor for 13 years

Named one of 2021 Top Wealth Advisors in Canada by Shook Research and the Globe & Mail

Big Five Canadian Bank owned brokerage firm

Eight checklist templates to help you articulate, develop or analyze your business model:

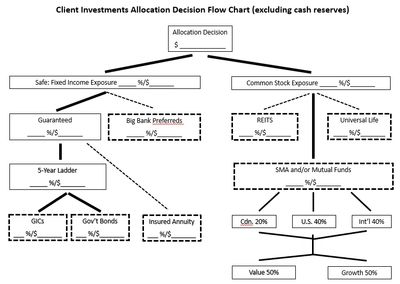

A template to prepare a concise and simplified summary of your approach to investing and a practical worksheet for meetings and conversations with clients regarding the allocations in their investment portfolio.

Note that some templates may not be exactly as pictured above or in the handbooks.